In today’s digital age, mobile payment integration has become an integral part of marketing strategies, revolutionizing the way businesses engage with consumers and facilitate transactions. Mobile payment integration refers to the seamless incorporation of mobile payment technologies into various marketing channels and platforms, enabling customers to make purchases conveniently and securely using their smartphones or other mobile devices. This paradigm shift has reshaped the retail landscape, empowering businesses to capitalize on the ubiquity of mobile devices and meet the evolving needs and preferences of consumers.

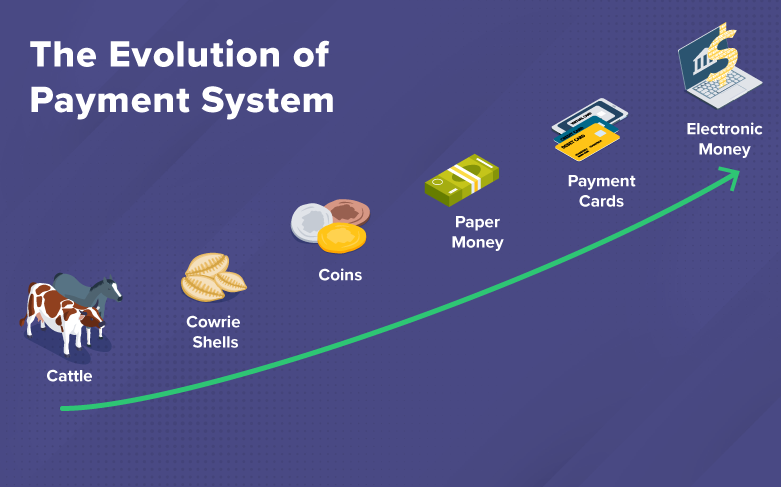

The Evolution of Mobile Payment Integration

The evolution of mobile payment integration traces back to the advent of mobile wallets and contactless payment technologies, which allowed consumers to store payment information digitally and make purchases with a simple tap or scan. As smartphones became more prevalent and mobile apps gained traction, businesses recognized the potential of leveraging mobile payment solutions to enhance the customer experience, drive sales, and foster loyalty. Today, mobile payment integration encompasses a diverse array of technologies and platforms, including mobile wallets, in-app payments, QR code scanning, and near field communication (NFC) technology.

Also Read: What is mobile marketing strategy?

Key Components of Mobile Payment Integration

Mobile payment integration involves several key components that enable businesses to accept payments seamlessly and securely via mobile devices:

- Mobile Payment Gateways: Mobile payment gateways serve as the intermediary between merchants, customers, and financial institutions, facilitating the secure transmission of payment data and processing transactions in real-time. These gateways support various payment methods, including credit cards, debit cards, digital wallets, and alternative payment methods.

Also Reads: What is the basic concept of payment gateway?

- Mobile Wallets: Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, enable consumers to store payment information securely on their smartphones and make contactless payments at participating merchants. These wallets leverage tokenization and encryption technology to protect sensitive data and ensure secure transactions.

- In-App Payments: In-app payments allow users to make purchases directly within mobile applications, eliminating the need to navigate to external websites or enter payment information manually. This streamlined checkout process enhances user convenience and reduces friction, resulting in higher conversion rates and improved user satisfaction.

- QR Code Payments: QR code payments involve scanning a QR code displayed at the point of sale using a mobile device’s camera or QR code scanning app. This method enables customers to initiate transactions quickly and securely, without the need for physical cards or cash. QR code payments are particularly prevalent in markets where mobile penetration is high, such as China and Southeast Asia.

- NFC Technology: Near field communication (NFC) technology enables contactless communication between mobile devices and payment terminals, allowing users to tap their smartphones or wearables to complete transactions. NFC technology powers popular mobile payment methods like Apple Pay and Google Pay, offering a fast, convenient, and secure payment experience.

Benefits of Mobile Payment Integration in Marketing

Mobile payment integration offers numerous benefits for businesses seeking to enhance their marketing efforts and improve the overall customer experience:

- Enhanced Convenience: Mobile payment integration enables customers to make purchases quickly and conveniently using their smartphones, eliminating the need for cash or physical cards. This convenience translates into faster checkout experiences and increased customer satisfaction.

- Expanded Reach: By embracing mobile payment technologies, businesses can cater to the growing segment of consumers who prefer to shop and transact on their mobile devices. Mobile payment integration allows businesses to reach customers anytime, anywhere, and engage them through targeted marketing campaigns and promotions.

- Improved Conversion Rates: Streamlined checkout processes and frictionless payment experiences result in higher conversion rates and reduced cart abandonment rates. Mobile payment integration eliminates barriers to purchase and encourages impulse buying, driving incremental revenue for businesses.

- Enhanced Security: Mobile payment technologies employ advanced encryption and authentication mechanisms to safeguard sensitive payment data and protect against fraud and unauthorized transactions. With built-in security features such as tokenization and biometric authentication, mobile payments offer a secure and trustworthy payment option for customers.

- Data-Driven Insights: Mobile payment integration provides businesses with valuable data and insights into customer behavior, preferences, and purchasing patterns. By analyzing transaction data and customer interactions, businesses can gain actionable insights to optimize marketing strategies, personalize offers, and drive customer engagement.

Considerations for Mobile Payment Integration

While mobile payment integration offers compelling benefits, businesses must consider several factors when implementing and optimizing mobile payment solutions:

- Compatibility and Integration: Businesses should ensure that their mobile payment solutions are compatible with their existing hardware, software, and POS systems. Seamless integration with e-commerce platforms, mobile apps, and CRM systems is essential to ensure a smooth and cohesive payment experience for customers.

- Security and Compliance: Mobile payment solutions must comply with industry standards and regulatory requirements for data security and privacy, such as PCI DSS (Payment Card Industry Data Security Standard) compliance. Businesses should prioritize security measures such as encryption, tokenization, and two-factor authentication to protect sensitive payment data and mitigate security risks.

- User Experience: A seamless and intuitive user experience is critical to the success of mobile payment integration. Businesses should optimize the checkout process for mobile users, minimize steps required to complete a transaction, and provide clear instructions and feedback to users throughout the payment process.

- Customer Support and Training: Businesses should offer comprehensive customer support and training resources to help users navigate the mobile payment process effectively. Educating customers on the benefits and features of mobile payment solutions can increase adoption rates and drive usage over time.

- Continuous Optimization: Mobile payment integration is an ongoing process that requires continuous monitoring, testing, and optimization to ensure optimal performance and user satisfaction. Businesses should track key performance metrics, gather customer feedback, and iterate on their mobile payment strategies to address evolving needs and preferences.

In conclusion, mobile payment integration represents a transformative opportunity for businesses to enhance their marketing efforts, streamline transactions, and deliver superior customer experiences in today’s mobile-driven world. By embracing mobile payment technologies and leveraging the benefits they offer, businesses can expand their reach, drive revenue growth, and cultivate lasting relationships with customers. With careful planning, implementation, and optimization, mobile payment integration can serve as a cornerstone of a successful marketing strategy, empowering businesses to thrive in an increasingly digital and mobile-centric marketplace.

Related Blog: Web design optimization for mobile devices?

FAQ:

- What is mobile payment integration in marketing?

- Mobile payment integration in marketing refers to the seamless incorporation of mobile payment technologies into various marketing channels and platforms, enabling customers to make purchases conveniently and securely using their smartphones or other mobile devices.

- Why is mobile payment integration important for businesses?

- Mobile payment integration enhances customer convenience, expands reach to mobile users, improves conversion rates, enhances security, and provides valuable data-driven insights for businesses to optimize their marketing strategies.

- What are some common mobile payment methods used in marketing?

- Common mobile payment methods include mobile wallets (e.g., Apple Pay, Google Pay), in-app payments, QR code payments, and NFC technology for contactless payments.

- How does mobile payment integration improve the customer experience?

- Mobile payment integration streamlines the checkout process, reduces friction for customers, enables faster transactions, and offers secure payment options, ultimately enhancing overall customer satisfaction.

- What considerations should businesses keep in mind when implementing mobile payment integration?

- Businesses should consider compatibility and integration with existing systems, security and compliance with industry standards, optimizing the user experience, providing robust customer support and training, and continuous optimization of mobile payment strategies.

- Are mobile payment integrations secure?

- Yes, mobile payment integrations employ advanced encryption, tokenization, and authentication mechanisms to protect sensitive payment data and ensure secure transactions, complying with industry standards and regulatory requirements.

- How can businesses leverage mobile payment data for marketing purposes?

- Businesses can leverage mobile payment data to gain insights into customer behavior, preferences, and purchasing patterns, enabling them to personalize marketing campaigns, optimize offers, and drive customer engagement.

- What are the benefits of using mobile payment integration for marketing campaigns?

- Benefits include enhanced convenience for customers, increased conversion rates, expanded reach to mobile users, improved security, and access to valuable data for optimizing marketing strategies.

- Can businesses track the effectiveness of mobile payment integration in marketing campaigns?

- Yes, businesses can track key performance metrics such as transaction volume, conversion rates, average order value, and customer retention to evaluate the effectiveness of mobile payment integration in marketing campaigns.

- How can businesses ensure a seamless user experience with mobile payment integration?

- Businesses can ensure a seamless user experience by optimizing the checkout process for mobile users, minimizing steps required to complete a transaction, providing clear instructions and feedback, and offering comprehensive customer support and training resources.

Leave A Comment